Unknown Facts About Pvm Accounting

Unknown Facts About Pvm Accounting

Blog Article

What Does Pvm Accounting Mean?

Table of ContentsWhat Does Pvm Accounting Mean?Pvm Accounting Fundamentals ExplainedNot known Facts About Pvm AccountingRumored Buzz on Pvm AccountingNot known Incorrect Statements About Pvm Accounting Pvm Accounting Things To Know Before You Get This

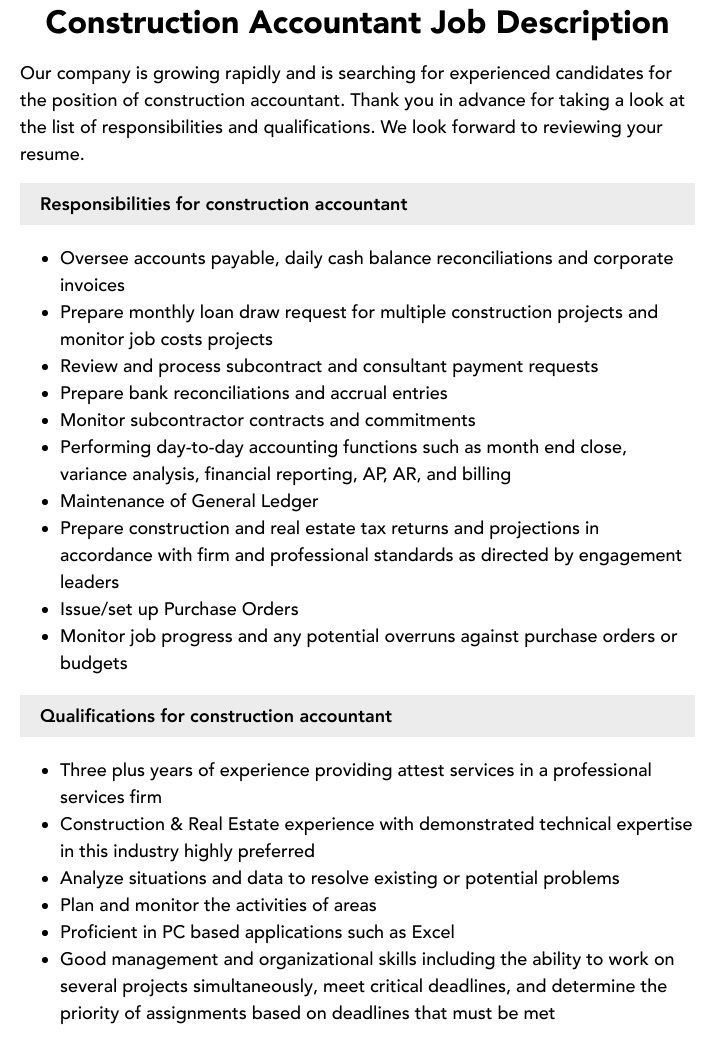

Look after and deal with the production and approval of all project-related invoicings to consumers to foster great communication and prevent concerns. construction bookkeeping. Make sure that appropriate reports and paperwork are sent to and are updated with the IRS. Make sure that the accounting process abides with the regulation. Apply required building accountancy standards and procedures to the recording and reporting of building task.Connect with different financing companies (i.e. Title Business, Escrow Company) concerning the pay application process and needs required for repayment. Help with executing and maintaining internal economic controls and treatments.

The above statements are intended to describe the basic nature and degree of work being performed by people appointed to this category. They are not to be understood as an exhaustive list of duties, tasks, and skills required. Employees may be required to execute tasks outside of their normal duties from time to time, as required.

The Ultimate Guide To Pvm Accounting

You will aid support the Accel group to ensure shipment of effective in a timely manner, on budget, jobs. Accel is looking for a Construction Accounting professional for the Chicago Workplace. The Building Accounting professional performs a range of audit, insurance coverage conformity, and task administration. Works both individually and within specific departments to keep financial records and make specific that all documents are maintained current.

Principal duties include, but are not limited to, dealing with all accounting functions of the business in a prompt and exact fashion and giving records and timetables to the firm's CPA Firm in the preparation of all financial statements. Guarantees that all bookkeeping procedures and functions are handled precisely. Accountable for all monetary records, payroll, banking and daily procedure of the audit feature.

Functions with Project Supervisors to prepare and post all month-to-month invoices. Generates regular monthly Job Price to Date reports and functioning with PMs to reconcile with Task Managers' spending plans for each project.

Pvm Accounting for Beginners

Proficiency in Sage 300 Building and Actual Estate (formerly Sage Timberline Workplace) and Procore building management software program an and also. https://www.provenexpert.com/leonel-centeno/?mode=preview. Need to also excel in other computer software application systems for the prep work of reports, spreadsheets and various other audit analysis that may be needed by monitoring. Clean-up bookkeeping. Have to possess strong organizational skills and capability to focus on

They are the economic custodians that ensure that building jobs stay on spending plan, adhere to tax policies, and preserve monetary transparency. Building accounting professionals are not simply number crunchers; they are critical companions in the building and construction procedure. Their key duty is to manage the financial aspects of construction projects, ensuring that resources are allocated efficiently and financial risks are minimized.

The Best Guide To Pvm Accounting

By preserving a limited hold on task finances, accounting professionals help protect against overspending and financial troubles. Budgeting is a cornerstone of effective construction jobs, and building and construction accountants are crucial in this regard.

Browsing the complex web of tax obligation regulations in the building sector can be challenging. Building accounting professionals are well-versed in these guidelines and make certain that the project conforms with all tax obligation requirements. This includes handling pay-roll taxes, sales taxes, and any type of various other tax responsibilities certain to building and construction. To excel in the function of a building and construction accountant, individuals need a strong instructional structure in accounting and financing.

Additionally, accreditations such as Cpa (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building And Construction Industry Financial Professional (CCIFP) are highly regarded in the industry. Working as an accountant in the construction industry comes with an unique set of challenges. Construction projects typically include tight due dates, altering laws, and unexpected expenses. Accounting professionals have to adapt rapidly to these difficulties to keep the task's economic health intact.

Fascination About Pvm Accounting

:max_bytes(150000):strip_icc()/forensicaccounting-Final-85cc442c185945249461779bcf6aa1d5.jpg)

Ans: Building and construction accountants create and check budget plans, identifying cost-saving chances and guaranteeing that the project remains within budget. Ans: Yes, construction accountants take care of tax conformity for building tasks.

Introduction to Building And Construction Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies need to make difficult selections among several monetary choices, like bidding on one task over one more, selecting financing for products or equipment, or setting a task's profit margin. Building and construction is an infamously volatile industry with a high failure price, slow-moving time to payment, and inconsistent money circulation.

Normal manufacturerConstruction service Process-based. Production entails repeated procedures with easily recognizable prices. Project-based. Production calls for different procedures, materials, and devices visit this site right here with differing expenses. Dealt with location. Production or production occurs in a solitary (or several) regulated locations. Decentralized. Each job occurs in a new place with differing site conditions and one-of-a-kind difficulties.

Get This Report on Pvm Accounting

Durable partnerships with vendors relieve arrangements and boost performance. Irregular. Constant use various specialty professionals and providers affects efficiency and cash flow. No retainage. Payment gets here completely or with normal settlements for the complete contract amount. Retainage. Some portion of settlement might be kept up until project completion also when the contractor's job is completed.

Regular manufacturing and temporary contracts result in workable cash circulation cycles. Uneven. Retainage, sluggish payments, and high ahead of time expenses result in long, irregular capital cycles - Clean-up accounting. While typical producers have the advantage of controlled settings and enhanced manufacturing procedures, building companies have to frequently adapt per new task. Even rather repeatable projects call for modifications as a result of site problems and other aspects.

Report this page